November 27, 2025

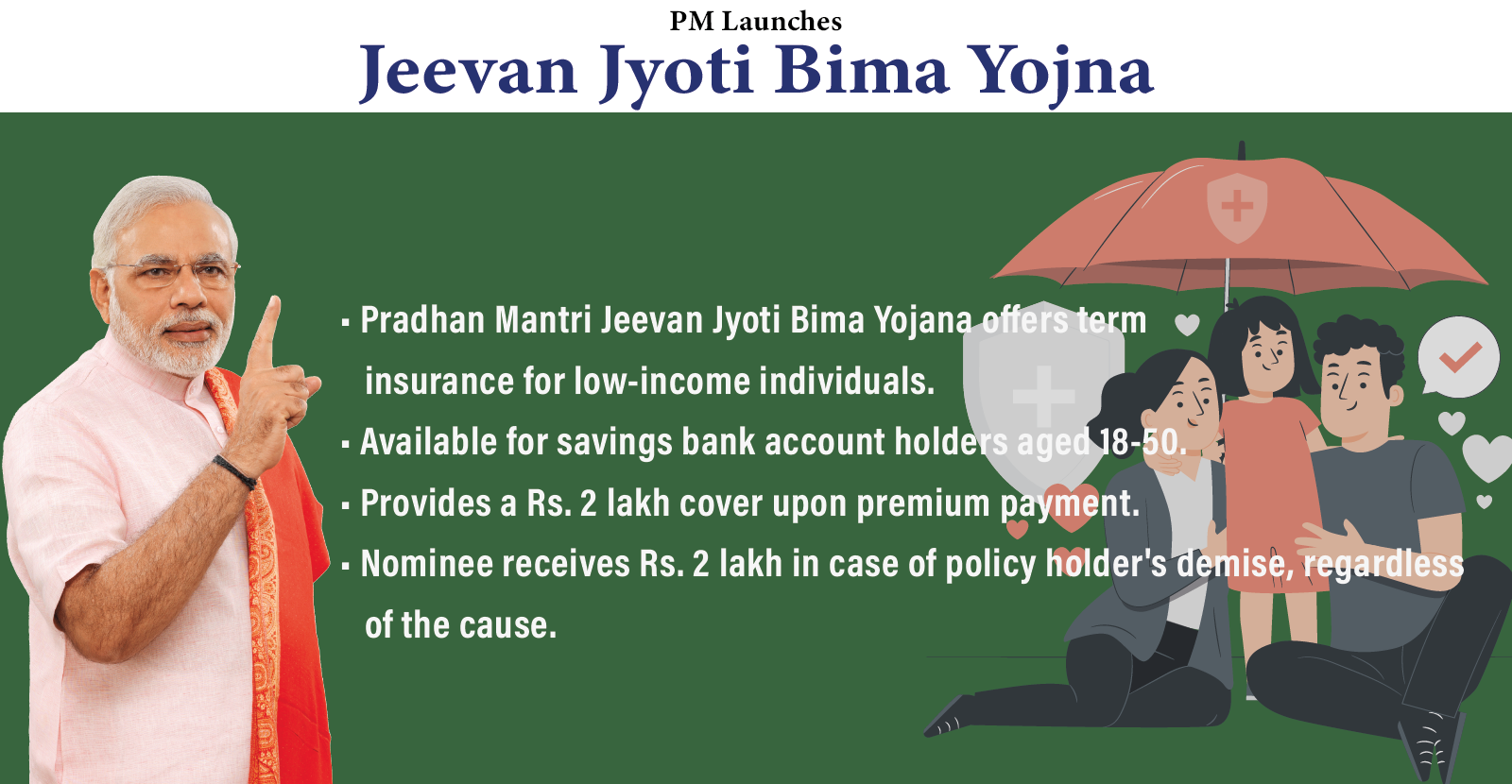

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a life insurance scheme valid for one year and renewable from year to year, offering coverage for death. PMJJBY is a pure-term insurance policy, which covers only mortality without any investment component.

Details of Pradhan Mantri Jeevan Jyoti Bima Yojana :

As mentioned earlier, this scheme is a one-year Insurance Scheme, and it offers life insurance cover for death due to any reason.

- The plan would be offered/administered through LIC (Life Insurance Corporation of India) and other Life Insurance companies willing to provide the product on similar terms with the required approvals and tie-ups with Banks for this purpose.

- Pradhan Mantri Jeevan Jyoti Bima Yojana Age Limit – PMJJBY can be availed by people who fall under the age group of 18 to 50 years ( life covers up to age 55) and have a savings bank account. Interested people who give their consent to join and enable auto-debit can avail of the benefits of this scheme.

- A life cover of Rs. 2 lakhs is available under the PMJJBY scheme at a premium of Rs.330 per annum per member and is renewable every year. If someone has a joint account, all the account holders can join the scheme, provided they meet its eligibility criteria and agree to pay the premium at the rate of Rs.330 per person.

Advantages:

- Affordability: The premium for PMJJBY is highly affordable, making it accessible to a large section of the population, especially those in the lower-income bracket.

- Life Coverage: The scheme provides a life insurance cover of Rs. 2 lakhs (as of my last update) in case of the insured’s death, ensuring financial assistance to the nominee.

- Easy Enrollment: Enrollment into the scheme is simple and straightforward, with minimal documentation requirements.

- Government Support: PMJJBY is a government-backed scheme, which adds credibility and trust among participants.

Eligibility:

- Age Limit: Generally, individuals aged between 18 to 50 years are eligible to enroll in PMJJBY. However, the age limit may vary depending on the specific guidelines set by the insurance provider.

- Bank Account: Applicants must have a savings bank account to enroll in the scheme. The premiums are usually auto-debited from the bank account annually.

- Consent: Participants must provide consent for auto-debit of the premium from their bank account and agree to the terms and conditions of the scheme.

- Renewal: The scheme typically requires annual renewal to maintain coverage.

It’s essential to verify the latest information and guidelines from official sources or insurance providers before enrolling in any government-backed scheme like PMJJBY, as the specifics might have changed since my last update.

Leave your comments here...